📘 Book Summary

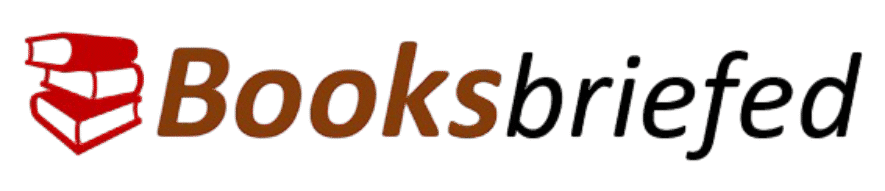

Rich Dad Poor Dad by Robert Kiyosaki is a groundbreaking personal finance book that challenges traditional views on money through the lens of two father figures. The “Poor Dad” represents conventional advice—get good grades, find a secure job, work hard, and save. The “Rich Dad” teaches financial independence through entrepreneurship, investing, and making money work for you.

Through compelling anecdotes and digestible lessons, Kiyosaki explains that wealth isn’t about how much you earn—it’s about how you manage, grow, and protect your money. Central to the book is the idea of financial literacy, understanding assets and liabilities, and shifting from an employee mindset to that of an investor or business owner.

🔑 Key Takeaways

- Assets vs. Liabilities: The wealthy buy assets that generate income; the poor acquire liabilities they think are assets

- Financial education > formal education: Traditional schools don’t teach money, keeping people in the rat race

- Work to learn, not to earn: Choose jobs that teach skills rather than provide the highest paycheck

- Mind your own business: Build your asset column even while working a regular job

- Leverage corporate structures: The wealthy use corporations to reduce taxes and protect assets

- Conquer fear and cynicism: Psychological barriers keep most people from achieving wealth

- Action is everything: Information is useless without implementation—start small but start now

📚 Overview

The book is structured around six core lessons Kiyosaki learned from his “Rich Dad” (his friend’s entrepreneurial father), contrasted with the more traditional beliefs of his “Poor Dad” (his biological father, a government employee).

Each lesson builds toward a more empowered view of personal finance, encouraging readers to rethink how they earn, spend, and invest money. Instead of offering exact investment strategies, Kiyosaki focuses on creating a new mindset rooted in ownership, financial education, and calculated risk-taking.

✍️ About the Author

Robert T. Kiyosaki is an American entrepreneur, investor, and educator born in 1947 in Hawaii. A former U.S. Marine and Vietnam War veteran, he transitioned from a sales career at Xerox to becoming a business owner and investor. His financial experiences—both successes and failures—form the basis of his teachings.

He’s best known for the Rich Dad series, which has sold over 40 million copies worldwide. Through his Rich Dad Company, Kiyosaki offers educational content via books, games, courses, and seminars focused on financial literacy and independence.

🌟 Reception and Impact

Rich Dad Poor Dad has become one of the most influential personal finance books ever published. It remained on the New York Times Best Seller List for over six years and has been translated into dozens of languages.

The book has helped shape the way millions think about money and investing. While some critics note its lack of actionable detail, the mindset shifts it inspires are credited with motivating people to pursue financial freedom, real estate investing, and entrepreneurship.

🌍 Plot and World-Building

Rather than a traditional plot, Kiyosaki presents a narrative rooted in life lessons. He builds a world divided by financial mindset: the employee mindset vs. the entrepreneur/investor mindset.

He also introduces his “Cashflow Quadrant,” which includes four types of earners:

- E: Employee

- S: Self-employed

- B: Business owner

- I: Investor

The ultimate goal is to move from the E and S quadrants into the B and I quadrants—where real financial freedom lies.

🎭 Main Storyline

The book follows Kiyosaki’s development as he absorbs lessons from both his “Poor Dad” and his “Rich Dad”:

- Act 1: Early Lessons – As a child, Kiyosaki observes the different financial behaviors of his two father figures

- Act 2: Young Adulthood – He begins applying Rich Dad’s principles, including investing and starting businesses

- Act 3: Financial Freedom – He achieves independence by building income-generating assets and escaping the “rat race”

Throughout, the focus remains on how mindset and education—not just effort—determine long-term wealth.

👑 Key Characters and Themes

Rich Dad – Symbolizes financial intelligence, entrepreneurship, and asset-building

Poor Dad – Represents conventional wisdom about education, job security, and saving

Robert Kiyosaki – The narrator and student of two opposing philosophies

Major Themes:

- Financial literacy as power: Knowing how money works is key to financial success

- Mindset matters: Wealth is a result of how you think, not just what you do

- Asset accumulation: Buy income-generating assets, not liabilities

- Entrepreneurship vs. employment: True freedom comes from ownership, not wages

- Learning through experience: Real-world lessons beat academic theory

- Calculated risk-taking: Overcoming fear and acting is essential to success

🧠 Who Should Read This?

- Beginners interested in money and investing

- Employees feeling stuck and looking for alternatives

- Young adults exploring financial independence

- Parents teaching kids about money

- Aspiring entrepreneurs and small business owners

- Real estate beginners seeking motivation

- Anyone frustrated by conventional financial advice

This book is especially useful for readers who want a mindset shift more than a technical manual.

💬 Best Quote

“The poor and the middle class work for money. The rich have money work for them.”

This quote captures the core distinction between mindsets—trading time for money vs. building systems that generate income passively.

📚 Final Thoughts

Rich Dad Poor Dad succeeds not by offering a step-by-step financial plan, but by shifting how people think about money. It’s a foundational read that encourages financial independence through education, action, and mindset change.

While the book lacks detailed investment instructions, its power lies in inspiring readers to pursue financial literacy and ownership. For best results, treat this as a launching pad—follow it with more practical guides on investing, business building, and tax strategy.

👉 Read This If You…

- Feel stuck in the traditional 9-to-5 grind

- Want to escape the rat race and build true wealth

- Are exploring real estate or side businesses

- Need motivation to take control of your finances

- Want to shift your mindset around money and success

- Are ready to start learning how to make money work for you

❓ FAQ

Q: Is the “Rich Dad” real?

A: Kiyosaki has never revealed his identity, which has sparked debate. He insists the lessons are true, regardless of the figure’s real-world existence.

Q: Is it suitable for beginners?

A: Absolutely. It’s written in a simple, story-driven style with no technical jargon.

Q: Does it teach specific investment strategies?

A: No. It focuses on mindset and principles, not tactical investing advice.

Q: Is the advice still relevant?

A: Yes, though some examples may feel dated, the core lessons on financial independence remain timeless.

Q: What should I read after this?

A: Consider books like Cashflow Quadrant, The Millionaire Real Estate Investor, or The Intelligent Investor to build on these principles with more actionable detail.